My Transformative Journey as a Kirchner Fellow

My name is Martin Adu-Boahene and I am currently an Undergraduate Senior majoring in Information Systems at Morgan State University. After spending a year as an HBCU Fellow in the Kirchner Fellowship, I am excited to share my experiences with the world and hopefully provide some insight into the program and encourage other students interested in exploring or pursuing a career path in Impact Investing to apply.

What attracted me to Venture Capital and Impact Investing

My interest in professional investing began during eleventh grade when I began to learn more about the gilded age and the capital markets. I was inspired by some of the pioneering figures of the American Industrial Revolution and the ways in which their industrial advancements and business empires shaped modern society. Throughout my final two years of high school, I acquired more knowledge about the stock market and got to understand some of the defining factors of public markets investing, such as risk and time. I became fascinated by companies filing to go public through the IPO process and reaching record-breaking valuations after multiple years of being listed on the stock exchanges. I began to add some of these companies’ stock to my tiny portfolio. After graduating from high school, I enrolled at Morgan State University; a historically Black institution located in Baltimore, Maryland to pursue a Bachelor’s Degree in Information Systems. I was particularly drawn to this major because it allowed me to take a mixture of courses in business and finance and then supplement them with information technology electives, giving me well-rounded knowledge and skill sets about the world of business, finance and technology. After my matriculation to Morgan State, I wanted to gain practical experience in the corporate world so I began to search for internships in a wide variety of fields. After several months of hard work and perseverance, I secured a position with KPMG; a professional services firm that offers a range of services, including audit, tax, and advisory services, to a variety of organizations, including some of the most well-known and influential ones around the world. During my internship, I worked on client engagements and projects in Higher Education, Alternative Investments, Insurance, and food-related industries.

I recall reading one of our school magazines, and surprisingly, in the student spotlight section was a former Morgan State alumni who had spent two summers interning with Intel Corporation’s Venture Capital arm, Intel Capital. What really surprised me about this story was finding out that during the time it was published only about 1% of Venture Capitalists in the industry were Black. This shocking revelation probed me to explore the world of Venture Capital and why there were so few Black professionals pursuing that career path. Through this journey I was introduced to HBCUvc. This organization was my stepping stone, enabling me to break into Venture Capital.

After interning with KPMG, I became interested in gaining exposure into early-stage investing and I was able to secure another internship with TEDCO, an independent organisation that strives to be Maryland’s lead source for entrepreneurial business assistance and seed funding for the development of start-up companies. This internship was made possible through the training and support I received from HBCUvc and I am grateful to this organization for providing me with this opportunity. I was hired by TEDCO as the first-ever intern on the Investment Team to evaluate new investment opportunities for the Pre-Seed, Seed, and Venture Funds with the Investment Professionals. I also prepared summaries of research and drafted several portions of the investment memos that were submitted to the CEO for final review and approval during my tenure. Indeed, this was an eye opening experience and I witnessed first-hand the importance of Venture Capital. After a successful completion of my internship with TEDCO, I went on to complete other internships with firms such as: J.P. Morgan, T. Rowe Price, Bain & Company, and Citigroup. I first heard about the Kirchner Fellowship through an email that was sent out to Morgan State students in the Spring of 2021. I wanted to enhance my knowledge and skillset particularly in areas such as Impact Investing, Food Security and Agriculture, given my background as an immigrant from Ghana, so I prepared and submitted all the necessary application materials for consideration. After several rounds of the interviews and a rigorous application process, I was selected to be a member of the inaugural HBCU cohort for 2021-2022.

Overview of the Inaugural HBCU Cohort of the Kirchner Fellowship

The HBCU Cohort of the Kirchner Fellowship was established to help address the lack of diversity within the VC sector. One of the truly unique things about this fellowship is that it assembles a small group of students, provides them with the capital and hands-on training on how to invest effectively in socially responsible early-stage companies and innovations. The student fellows are also given full discretion to form an investment committee, develop an investment mandate, source, diligence, and eventually select a promising start-up to pursue an investment.

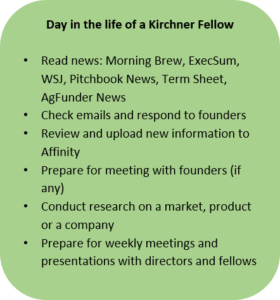

The HBCU program was launched in July 2021. The inaugural fellows that were selected included Bryanna Pittman who was pursuing a Bachelor of Science in Biological Systems Engineering at Florida A&M University in Tallahassee, Florida, Florida and Kwame Terra who was pursuing a Master of Public Health in Health Equity at Xavier University in New Orleans and myself. In the program, we spent the first two months in training and formulating our Investment Mandate or Thesis. After developing our Investment Mandate we began sourcing and evaluating deals that came into our pipeline. Furthermore, we received supplemental trainings and covered topics such as: financial analysis, dilution, assessment of impact, term sheets and negotiation, as well as other topics throughout the year. We were also expected to apply the concepts we had learned in the real world before returning to discuss what transpired and receive feedback. In contrast to just attending lectures, this “learning by doing” helped concepts get cemented in my memory far more effectively. In the final months of the fellowship, we spent more time conducting deeper diligence on our top companies and drafted an Investment Memorandum for the company we unanimously decided to pursue an investment in.

Investment Mandate

The inaugural cohort developed an investment mandate which was to invest in a revenue generating company that improves the nutritional health of predominantly Black communities in the United States. This mandate was influenced by our unique backgrounds, cultural influences and the health disparities found in our communities which can, to some extent, be linked back to the types of food we consume on a daily basis. While calorie-dense fast-food restaurants are widely available, access to high-quality food is limited in African American communities. In a survey of 5,370 census blocks spread across New York City’s five boroughs, it was revealed that regions with a larger concentration of African Americans compared to White Americans had mainly fast food franchises and independently owned small eateries.[1] The presence of fast-food establishments and the type of food available in African American communities have a direct impact on several health concerns afflicting the population. The lack of access to healthy foods in the aforementioned communities was the problem we wanted to address with our investment mandate.

The inaugural cohort developed an investment mandate which was to invest in a revenue generating company that improves the nutritional health of predominantly Black communities in the United States. This mandate was influenced by our unique backgrounds, cultural influences and the health disparities found in our communities which can, to some extent, be linked back to the types of food we consume on a daily basis. While calorie-dense fast-food restaurants are widely available, access to high-quality food is limited in African American communities. In a survey of 5,370 census blocks spread across New York City’s five boroughs, it was revealed that regions with a larger concentration of African Americans compared to White Americans had mainly fast food franchises and independently owned small eateries.[1] The presence of fast-food establishments and the type of food available in African American communities have a direct impact on several health concerns afflicting the population. The lack of access to healthy foods in the aforementioned communities was the problem we wanted to address with our investment mandate.

Results

In order to identify the next promising start-up which addresses the aforementioned problem, we sourced over 60 early stage companies, conducted due diligence on 10 of these companies and deep diligence on five of them to eventually decide on a viable investment opportunity. The purpose of the extensive diligence process was to obtain as much information as possible about the potential investment in order to make an informed decision about whether or not to proceed with the investment. Although most of our interactions with founders were virtual, we got the opportunity to visit a few of them in California and toured a manufacturing plant of one the start-ups we were considering for investment. One of the major problems we encountered was identifying a company that fit perfectly with our investment mandate and had opportunities for growth and scaling given the area we were targeting. Ultimately, our investment didn’t materialize during our tenure in the fellowship for a variety of reasons relating to the company’s financial situation, price of products, and supply chain risks; however, that is part of being an investor and it certainly does not take away from what I learned during the program.

Support from Directors

All of the success we accomplished wouldn’t have been possible without the tremendous amount of support and guidance we received from the program directors, external advisors and the strong alumni of Kirchner Fellows. The program provided 1:1 support of directors to fellows, which gave us incredible access to their experience and expertise to assist our learning. We sincerely appreciated their devotion to the success of this program and the dedication to making themselves easily accessible any time we needed to consult them for guidance or advice.

Lessons Learned and Impact of the Fellowship on My Career

Being a fellow in this unique program has been a truly remarkable experience. I have been able to develop a better understanding of the key elements of a successful start-up including but not limited to, size of the market, business model, environmental and social impact, and the quality of the founding/management team. Interacting with founders and hearing their story or their “why” has given me a deep appreciation for entrepreneurs who dare to take bold risks by addressing some of the critical problems facing our society today. In my opinion, a successful Kirchner Fellow is a student who stays curious, remains a lifelong learner, self-starter and enjoys nurturing relationships with founders, investors, and other stakeholders. The advice I will give to any student interested in applying for this program is to be open-minded, don’t be afraid to step outside your comfort zone, and APPLY!

As I wrap up my final year at Morgan State University, I am excited to continuously work with the Kirchner Impact Foundation in a new capacity as an Adjunct Director for the HBCU cohort of the Kirchner Fellowship. I am thrilled to be working with the amazing directors and new talented fellows and sharing my insights and experiences as a member of the inaugural cohort with the team. Upon completing my studies at Morgan State University in May 2023, I aspire to pursue a career in investing with the aim of assisting underrepresented founders in securing the funding and support they need to grow their businesses. My ultimate goal is to help bridge the funding gap for these founders.

[1] Kwate NO, Yau CY, Loh JM, Williams D. Inequality in obesigenic environments: fast food density in New York City. Health Place. 2009 Mar;15(1):364-73. doi: 10.1016/j.healthplace.2008.07.003. Epub 2008 Jul 16. PMID: 18722151.